Automated HS Code Classification

Revolutionize your product catalog with Plusius’ automation tools and processes. Make the goods classification process fast, simple, and accurate with our automated HS code classification service.

Revolutionize your product catalog with Plusius’ automation tools and processes. Make the goods classification process fast, simple, and accurate with our automated HS code classification service.

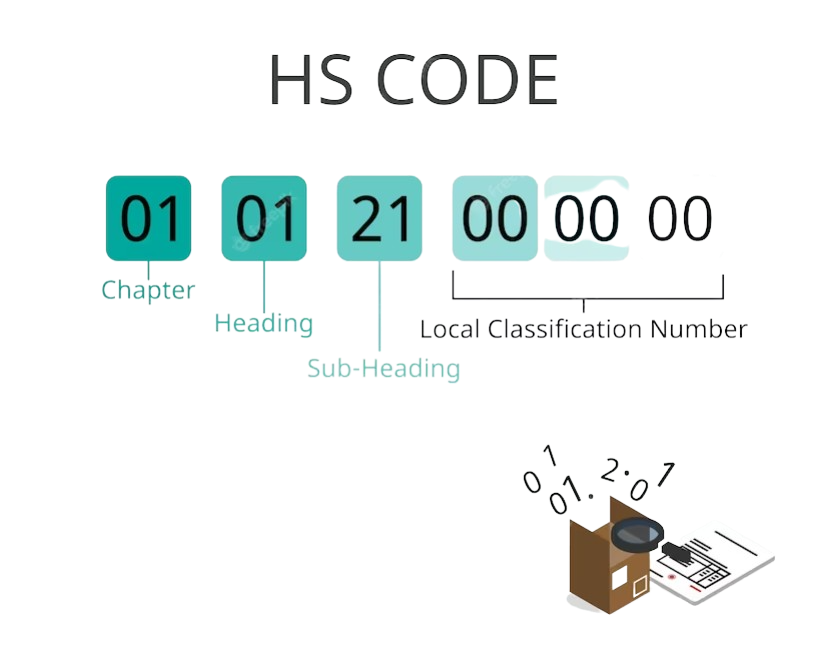

The HS code simplifies the complex world of international trade. It's a uniform system of names and numbers used to categorize goods, making it easier for customs authorities to determine the nature and value of what's being traded.

Maintained by the World Customs Organization (WCO), the HS code is utilized by over 200 countries and territories to classify their goods for customs purposes. By providing a common language for trade, the HS code ensures the efficient and accurate classification of goods and the calculation of duties and taxes.

HS code classification results in the facilitation of international trade, accurate calculation of duties and taxes, streamlining of the customs process, and transparency with consistency.

HS codes provide a common language for international trade, making it easier for customs authorities to identify and classify goods being traded.

HS codes are used to determine the nature and value of goods, allowing customs authorities to accurately calculate duties and taxes.

As part of a standardized system of codes, the HS code simplifies the process of customs clearance and reduces the time and effort required for the documentation and processing of goods.

HS codes ensure that goods are classified consistently and transparently, reducing the possibility of disputes and misunderstandings between trading partners.

When customs assigns HS codes on imports it is important to consider that additional duty and tax charges may occur with the risk of discrepancies due to incurred charges and issues in accounting and budget.

The consequences of missing or inaccurate HS codes are as follows:

Customs authorities may need to take additional time to manually review and classify the goods.

Overpayment or underpayment of customs duties and taxes, potentially resulting in financial loss or penalties.

Misclassification of goods, which could have implications for regulatory compliance, such as fines, penalties or legal actions.

Customers, suppliers, and partners may lose trust in a company's ability to effectively manage its supply chain and comply with customs regulations.

Delayed shipments lead to production delays, stockouts, and increased costs and company ability to meet customer demand and fulfill orders.

Contact us to get more information on HS code classification and the benefits of complete and accurate data.

info@plusius.io

Message is sent

Failed to send message