Easy collection and money forwarding.

We start where PSPs end

Plusius' caters to the entire payment life cycle and enables to collect, process, and settle payments from multiple sources. Our payment ecosystem containts payment gateways, acquiring banks, and payment networks that work together to facilitate secure and efficient payment transactions.

The system complies with various security and compliance standards to ensure the safety and privacy of sensitive payment information.

Regardless of the payment stream's complexity, we facilitate your settlement demands to multiple recipients in real-time, while covering the enhanced KYC/AML work for you, to make sure that your business is on the right side of the law.

Collection

Businesses can benefit from Plusius' global coverage, which includes support for local and SWIFT payouts in over 148 countries and regions and over 40 currencies. To ensure faster and more cost-effective payouts, Plusius is connected to local clearing systems in over 90 countries.

Escrowing

Without escrow services, you may be exposing your business to significant risks and challenges known as payment disputes, lack of trust, fraud risk, payment processing delays, and legal and regulatory issues.

Plusius' escrow services will help your business to mitigate these risks and improve your overall financial management and relationships with your customers and partners.

Reconciliation

You are manually verifying transactions, addressing discrepancies, and trying to keep track of everything, but it's taking up a lot of your time and resources, but as your business expands, you are finding it harder and harder to keep up with the financial management of your business.

With Plusius, you no longer have to manually verify transactions or address discrepancies - the system takes care of everything for you. You will be able to focus on what you do best - growing your business - while Plusius takes care of the financial management of your business.

Localization

To optimize your efficiency of transfers and reduce unnecessary fees, localization may involve selecting transfer methods that are specific to the region, such as SEPA transfers in Europe or ACH transfers in the United States. Additionally, it may involve the acceptance of payments in local currencies, which can mitigate the risk of currency fluctuations and lower foreign exchange fees.

With localization your businesses can ensure that transfers are processed quickly and with minimal fees and delays.

Payout Splitting

The process of manually splitting payments among multiple beneficiaries is be time-consuming, error-prone and inefficient, especially your business has to deal with a large volume of transactions. The results of manual handling are delayed payouts and the risk of your business not staying compliant.

Plusius automates the full process for better scalability to handle large volumes of transactions without compromising efficiency or accuracy.

Recurring Payments

Plusius offers recurring payments that benefit for the convenience of your customers by eliminating manual payment processing and minimizing the risk of late or missed payments. These payments can be initiated by either the merchant or the customer and involve an agreement to pay a fixed amount on a predetermined schedule.

We provide the option for recurring payments, which is an automatic payment system set up to occur regularly, such as weekly, monthly, annually or whenever your business reaches certain goal when you have fulfilled pre-existing condition.

No need for changing your Payment Service Providers

All of our systems and all these things work in combination. Normally client will use collection, escrow, payout splitting and recurring payments at one product that they are buying form us.

Are you a fintech, financial institution with your own license or a bank in need of a payment infrastructure solution?

Integrate directly with Plusius to collect, hold and split funds as well as to optimize currency conversion for international transfers. Plusius is an addition to your PSPs acting as a complex process orchestrator for asset management. Our settlement accounts work as a settlement body toward your partners.

01

Standard

02

Fintech

Full escrowing solution and line-by-line auditing.

03

Infrastructure

Full infrastructure solutions holding and issuing bank accounts.

CONTACT US

Do you have a challenge?

Our team is ready for your enquiry.

info@plusius.io

Message is sent

Failed to send message

Zero risk

No Risk for the merchant—taxes are collected and held. No Risk for the IOSS intermediary—funds are securely escrowed before having to pay the

government tax agencies.

Real-time settlement

The IOSS regulation demands for the total landed cost to be transparently represented to customers. Payments from the EU for cross-border orders are collected in the EU, and all the recipients included in a total landed cost receive their money in real time.

HS Code Classification

Your business without the correct HS code classification will suffer customs clearance delays and potential penalties, paying too much or too little in duties and taxes, compliance issues and potential legal problems, as well as products being seized or destroyed.

Plusius is revolutionizing the industry with its top-of-the-line classification tool that utilizes machine learning to provide instant and precise outcomes.

Customs Clearance

Customs clearance can be a complex and time-consuming process for your business where one of the most common problems for cross-border logistics and e-commerce is a clear understanding of the customs regulations for the country where you are importing goods.

Plusius automates the whole process and partners with experienced customs brokers and logistics providers, to navigate your business and make your processes smooth.

Localization

You can select your desired delivery destination, and the shopping cart will automatically calculate the customs duties and taxes in the local currency.

We will help you manage product restrictions based on the country and prevent fraud and counterfeiting with our AI. If you are interested in learning more, please contact our sales team.

Cross-Border Tax Collection

If you deal with IOSS intermediaries and fiscal representatives, you will face the complex task of collecting and escrowing taxes due to the joint liability rules within the EU.

The IOSS VAT intermediaries partnering with us are running a safer and frictionless business. If you are a merchant exporting to any of the EU member states, get in touch with us for recommendations of IOSS intermediaries integrated with Plusius for smarter cross-border payments.

Delivery Duty Paid

Your customers receive a parcel and face the problem of a lost or delayed tax invoice that in the worst case may result in penalties.

Plusius converts Delivery Duty Unpaid (DDU) to Delivery Duty Paid (DDP) via automation and technology. We enable you to be ahead of the game and increase your customers' lifetime value and satisfaction with the transparent total landed cost in your e-commerce checkout.

Currency

To facilitate the exchange of goods and services between countries, supporting currencies is essential for you to engage in international trade to reduce currency risk, increase competitiveness, improved cash flow, and moreover enhance customer satisfaction.

With Plusius it is possible to exchange or make payments in more than 55 currencies internationally. Please, contact info@plusius.io to get more information.

01

CLEARANCE

Over 1 million parcels daily pending clearance and transit across the EU borders.

02

RETURNS

High levels of returns due to unpaid taxes. Approximately 17% parcels are returned daily because of the wrong total landing cost estimation at e-commerce website checkout.

03

COMPLIANCE

Variety of regulations and standards, including environmental regulations and customs requirements. It is time-consuming and complex, particularly when dealing with international shipments.

04

IMPACT

Returned parcels and additional transportation result in massive unnecessary carbon dioxide (co2).

Logistics Industry

For a long time, logistics companies have been searching hard to ensure that duty and tax are paid by consumers at the point-of-sale and guaranteed with the customs declarants. Client funds management requires a financial license.

With a proof of concept, Plusius handles logistics companies' incoming and outgoing payments globally, escrows money, and settles in multiple currencies including the settlement to all 27 Tax Agencies in the EU for IOSS Tax Payments. Plusius has optimized and automated the Delivered Duty Unpaid (DDU) flows and Delivered Duty Paid (DDP) clearance for smooth finance management. Read more about different types of use cases.

CONTACT US

Do you have a challenge?

We are looking forward to your message.

info@plusius.io

Message is sent

Failed to send message

KYC, AML and Fraud Prevention

As a financial institution, besides providing financial services, Plusius also ensures high standards of anti-money laundering procedures.

We use third-party actors, lists, and behavior patterns to flag suspicious conduct and prevent fraud. We give the companies affected by possible money laundering the tools to act.

Our services, all of them, have no money source based on cash. There is no source of money that isn't coming from a bank or financial institution which in turn has got their funds from a bank. The entire chain is and will continue to be 100 % traceable.

Deep and Comprehensive KYC and AML

Ensure that your business is safe and not acting on behalf of clients who conduct money laundering or terrorist financing. With Plusius, banks and enterprises know exactly to whom a transaction belongs.

Plusius is a source of data consignment and anti-fraud shield for your institution.

Existence, data validation, reputation, background checks and more— all in one —for fraud detection and prevention. Besides PSPs already providing KYC and AML checks, we complete the missing puzzle pieces with data investigation from over 400 sources (governments, banks, business registers, biometrics, etc.) from all the 195 countries of the world.

Third-party data aggregator

We use the XRAY data aggregator and supplier for customers and businesses verification, clients of our clients' verification, real-time AML checks, PEP, watchlist, sanctions checks and more. XRAY is our trusted partner for financial and legal investigation to keep our business and our clients' business compliant with the law.

CONTACT US

Do you have a challenge?

We are looking forward to your message.

info@plusius.io

Message is sent

Failed to send message

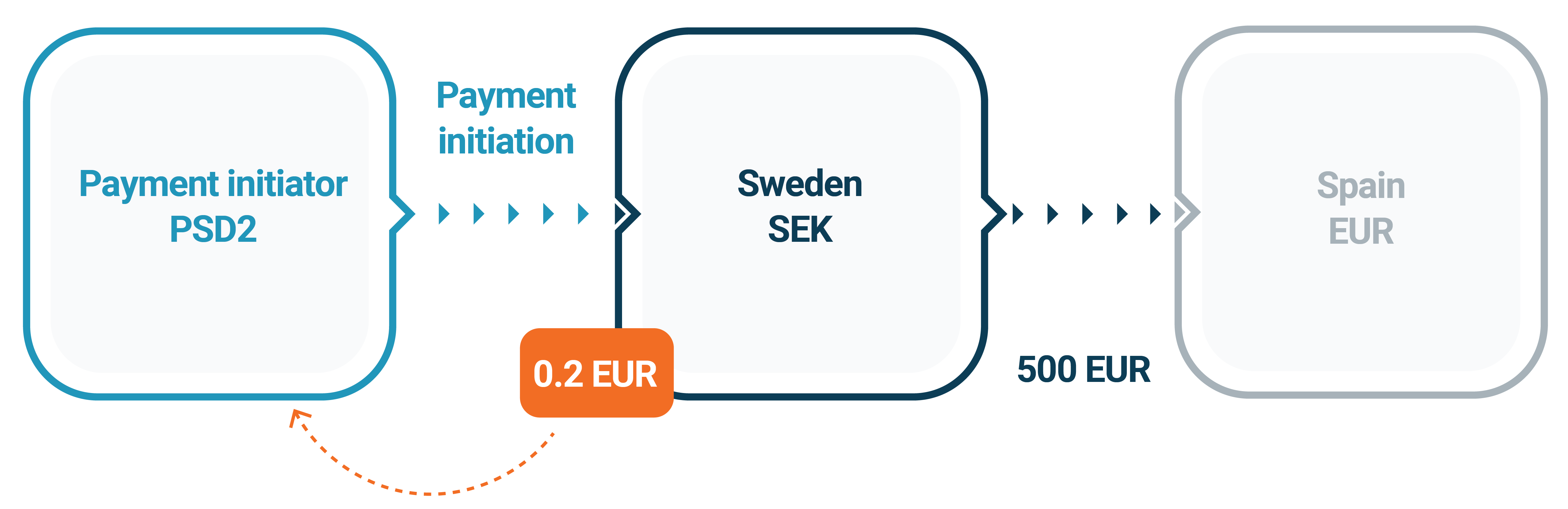

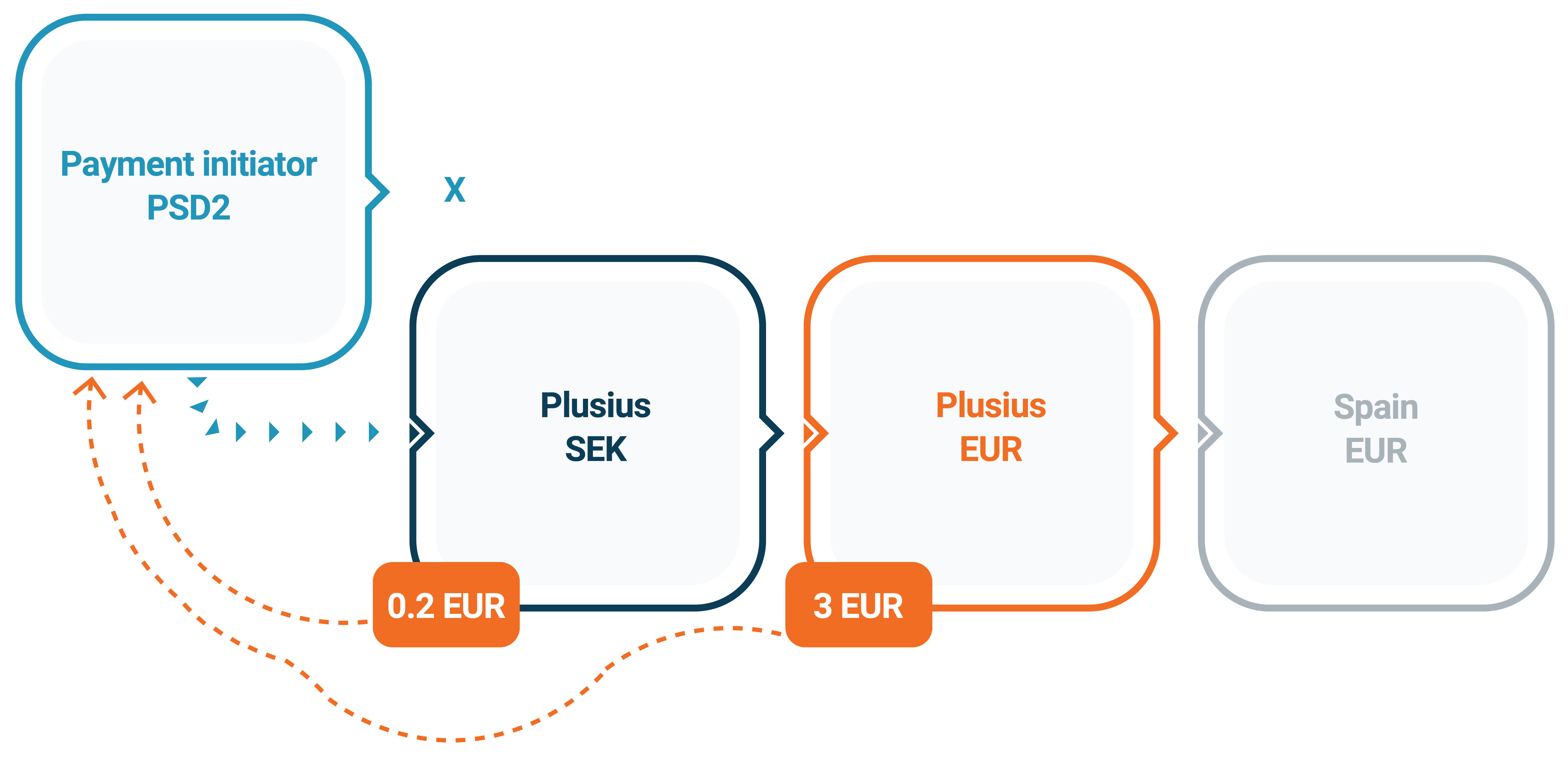

PSD2 AIS and PIS actor?

Plusius opens to you a hefty business model with revenues from your payment initiation, transaction settlement, currency conversion, and more—customized particularly to a partnership. Collect on the go! No need for billing afterwards, all is in the split model.

An extension to your service

Plusius acts as a complex process orchestrator for asset management. Our settlement accounts work as a settlement body towards your partners.

If the old way is limiting your payment institution in settling funds to international recipients, then our way streamlines the flow while increasing your revenue.

Utilize the Plusius network of banks to earn on transactions.

As a financial institution, Plusius reconciles the funds and flows

making sure that all options for all countries are optimized - with NO

unnecessary costs.

CONTACT US

Do you have a challenge?

We are looking forward to your message.

info@plusius.io

Message is sent

Failed to send message